jersey city property tax calculator

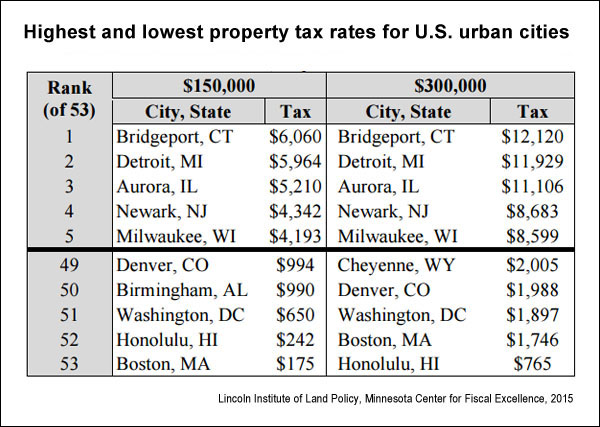

This northern New Jersey county has effective property tax rates that are more than double the national average. Baltimore City has one of the highest median property taxes in the United States and is ranked 543rd of the 3143 counties in order of median property taxes.

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

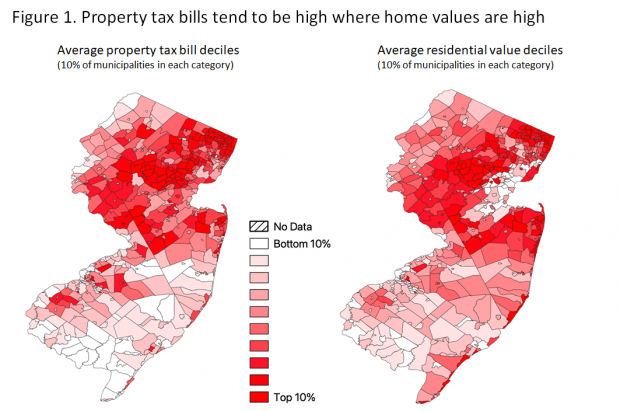

In Bergen and Essex Counties west of New York City the average annual property tax bill is over 10000.

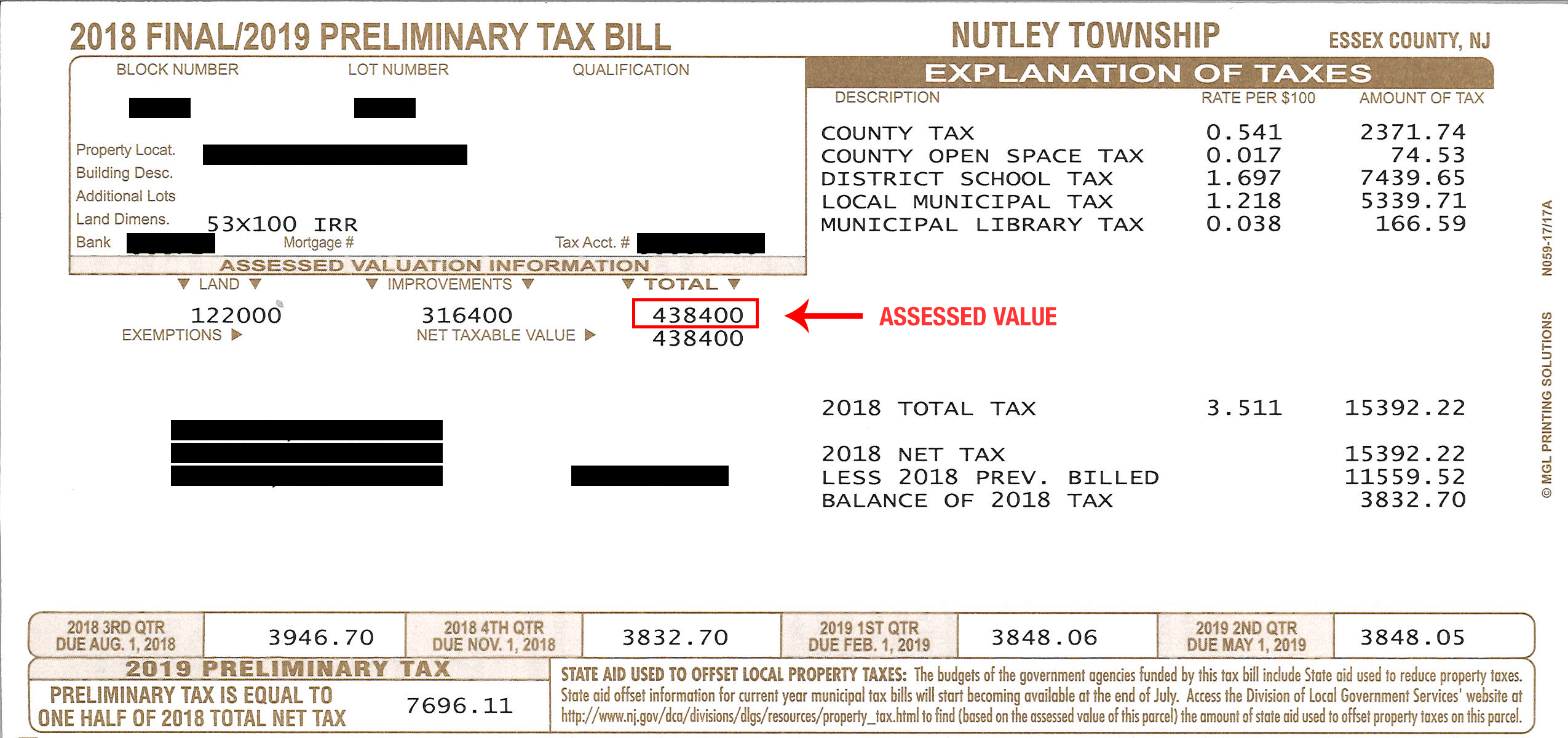

. Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property. The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a. Prior to 2018 the maximum property tax deduction was 10000.

Virginia is ranked 29th of the 50 states for property taxes as a percentage of median income. Below you will find a table with the average. The median property tax in Baltimore City Maryland is 1850 per year for a home worth the median value of 160400.

Starting with tax year 2018 you can now deduct up to 15000 of property taxes. Baltimore City collects on average 115 of a propertys assessed fair market value as property tax. The exact property tax levied depends on the county in Virginia the property is located in.

Falls Church city collects the highest property tax in Virginia levying an average of 094 of median home value yearly in property taxes while Buchanan. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hill can help you out. The countys average effective property tax rate is 346.

Local governments typically assess. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return. New Jerseys real property tax is an ad valorem tax or a tax according to value.

All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. While Cape May County has the lowest property tax rate in NJ with an effective property tax rate of 128. Camden County has the highest property tax rate in NJ with an effective property tax rate of 391.

The Minimum Salary You Need To Be Happy In Every State Find A Job Can Money Buy Happiness Happy

Township Of Nutley New Jersey Property Tax Calculator

5 Reasons To Sell Before The Selling Season Picks Up By Jeff Kram Things To Sell Austin Real Estate Selling Your House

Pin By Tu On Buildings Home Design Software Home Design Software Free House Exterior

U S Property Taxes Comparing Residential And Commercial Rates Across States

Nyc Home Prices Plunge After Salt Deductions Capped

New York Property Tax Calculator 2020 Empire Center For Public Policy

New York Property Tax Calculator Smartasset

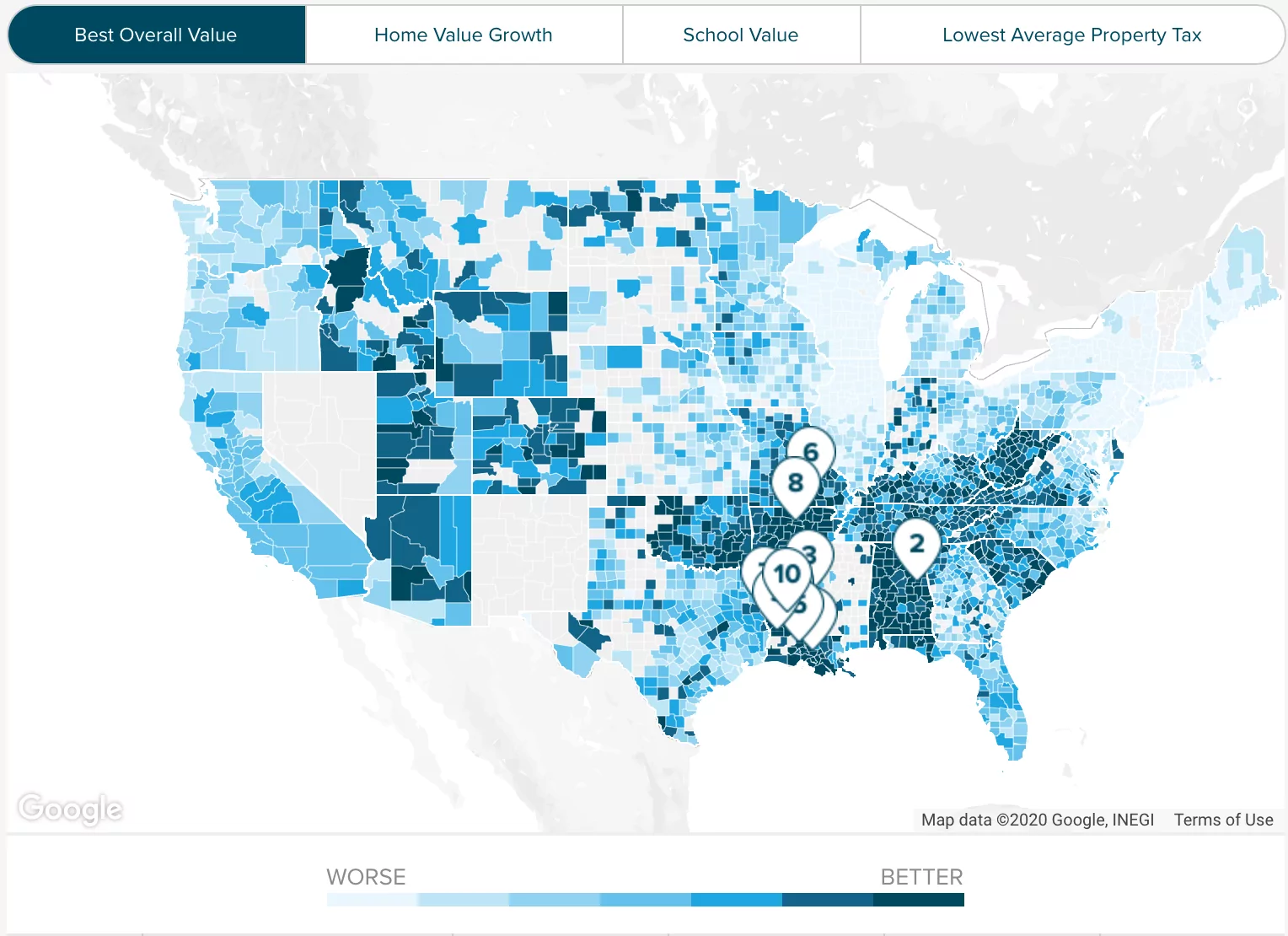

2022 Property Taxes By State Report Propertyshark

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Tax Bill Breakdown City Of Woodbury

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Tax How To Calculate Local Considerations

Riverside County Ca Property Tax Calculator Smartasset

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

The Outstanding Printable Home Inspection Report Template Elegant 2018 Home Intended For Property Management Inspectio Report Template Best Templates Templates

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future